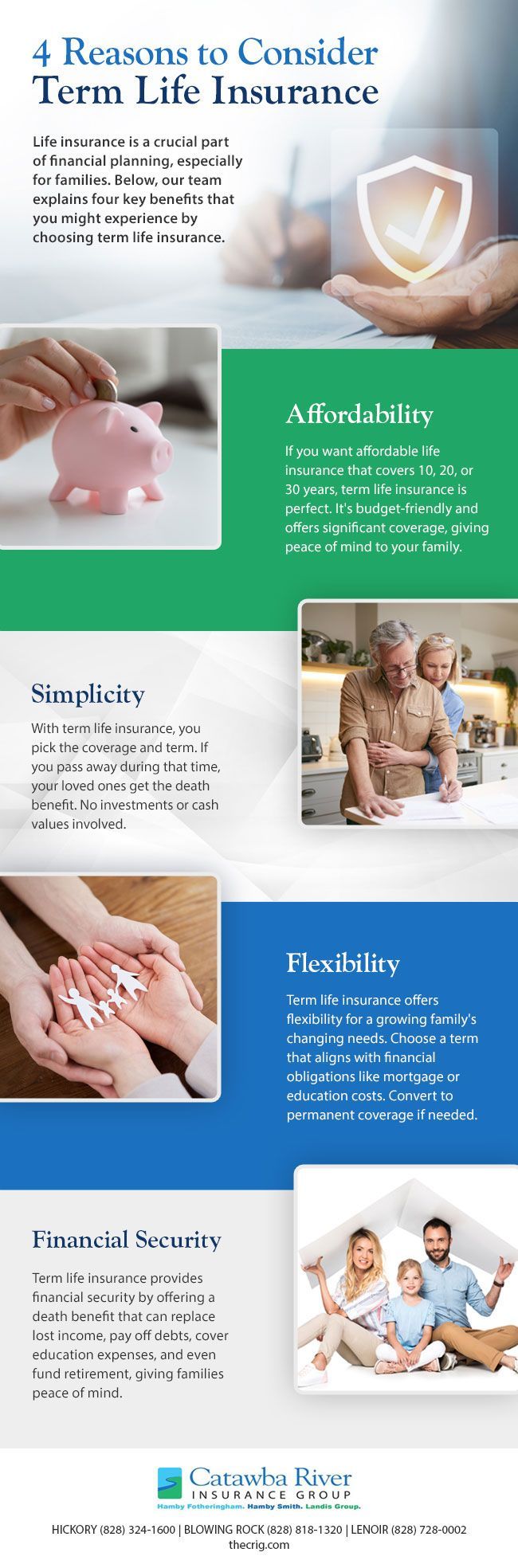

Four Reasons to Consider Term Life Insurance [infographic]

Life insurance is a crucial part of financial planning, especially for families. Among the various types of life insurance available, term life insurance often stands out as a top choice amongst families.

Below, our team explains four key benefits that you might experience by choosing term life insurance over other life insurance options.

- Affordability. If you are looking for an affordable type of life insurance that will cover 10, 20, or 30 years, term life insurance is a great option. This affordability allows families to secure substantial coverage even on a tight budget, ensuring financial protection for their loved ones.

- Simplicity. With term life insurance, you simply choose a coverage amount and term length. If you pass away within that term, your beneficiaries receive the death benefit. Unlike some types of permanent life insurance, there are no investment components or cash values to consider.

- Flexibility. Term life insurance offers flexibility that can match the changing needs of a growing family. You can choose a term that aligns with your family’s significant financial obligations, such as mortgage repayment or children’s education costs. If your needs change, many policies allow you to convert your term policy to a permanent one, providing lifelong coverage.

- Financial Security. The primary purpose of any life insurance is to provide financial security, and term life insurance excels in this aspect. The death benefit can replace lost income, pay off debts, cover education expenses, or even fund your spouse’s retirement. This financial safety net can give families peace of mind, knowing they have protection against life’s uncertainties.

It’s always important to assess your family’s needs and consult a trusted insurance advisor to choose the right life insurance policy. If you need help choosing a policy that’s right for you, contact our team at The Catawba River Insurance Group today.

The post Four Reasons to Consider Term Life Insurance [infographic] first appeared on The Catawba River Insurance Group.